Rework

Josh Poulson

Posted in category “Business, Technology” Tuesday, Mar 16 2010 07:54 AM | Permalink | No comments | No trackbacks

Josh Poulson

Posted in category “Business, Technology” Tuesday, Mar 16 2010 07:54 AM | Permalink | No comments | No trackbacks

The Tax Foundation brings us a catchy tune explaining Cap and Trade:

(Hat tip to Hot Air.)

Josh Poulson

Posted in category “Business, Politics” Sunday, Jul 5 2009 09:52 AM | Permalink | No comments | No trackbacks

The Center for Freedom and Prosperity has a new video:

Josh Poulson

Posted in category “Business, Politics” Monday, Jun 15 2009 03:42 PM | Permalink | No comments | No trackbacks

Mr. 10000Pennies is back!

Watch it and really understand what an information dump is.

(Hat tip to Instapundit.)

Update: Via Day By Day we find that 10000Pennies has a blog called Political Math and he posted the video with an explanation there.

Josh Poulson

Posted in category “Business, Politics” Tuesday, Jun 9 2009 05:24 PM | Permalink | No comments | No trackbacks

(Hat tip to Hot Air.)

Josh Poulson

Posted in category “Business, Politics” Monday, Jun 8 2009 06:13 PM | Permalink | No comments | No trackbacks

I should create a “too little, too late” category to characterize the latest effort of the Republicans to decrease the $3.6T budget by 0.64%. What's needed to rescue the economy from the Internet and housing bubble collapses is a sound fiscal policy, a sound monetary policy, and a realistic view of big government spending.

The GOP has no credibility on fiscal restraint, and hasn't since Bush 41, and the Democrats think they are resurrecting FDR in Obama, when instead FDR, Carter, and Obama are all cut from the same cloth. Obama speaks out against deficit spending from one side of his mouth, and spews a $3.6T budget blueprint onto an eager-to-spend Congress from the other.

What needs to be done, now, is to end the stimulus and rescue measures immediately and to focus instead on restoring the capital markets by remaking the United States as an attractive place for businesses that make real things for real people as quickly as possible. That's why I support infrastructure improvements but decry borrowing to make them happen.

I'm unhappy that there appears to be no leader that is making a credible call to end the borrow-and-spend cycle and to strengthen the dollar, but I have no credibility to make them do it myself.

Josh Poulson

Posted in category “Business, Politics” Thursday, Jun 4 2009 10:35 AM | Permalink | No comments | No trackbacks

Josh Poulson

Posted in category “Business, Politics” Wednesday, Jun 3 2009 10:07 PM | Permalink | No comments | No trackbacks

To go with yesterday's M&A news, Microsoft has bid $44.6B for Yahoo! That's a pretty big threat to Google, and already Yahoo! shares are up 50% and Google is down nearly 10%. Of course, one wonders what it would be like to integrate the diverse offerings of Microsoft and it's Live strategy and Yahoo! with it's zillions of other acquisitions over the years. It's not just about M&A cash, it's about executing on the integration afterward that really counts.

Josh Poulson

Posted in category “Business” Friday, Feb 1 2008 09:28 AM | Permalink | No comments | No trackbacks

I admit I haven't written in a while, but here's a more interesting story than the political cess that's been depressing me lately. Amazon is buying out Audible.com for $300M. I've been an Audible.com subscriber for years and I've been buying from Amazon.com since the mid-90's, so this is an interesting merger to me. Amazon's recommendation engine and related electronic materials will be a welcome addition to the always-good-quality Audible books and podcasts.

Josh Poulson

Posted in category “Business” Thursday, Jan 31 2008 11:50 AM | Permalink | No comments | No trackbacks

Influential economist Milton Friedman has died. While he can be damned for inventing withholding he is to be lauded for his unabashed love for capitalism for enabling freedom. He was the founder of the Chicago School of monetary economics, in contrast to the Keynes and Austrian schools (among others).

I especially enjoyed his 1980 PBS series Free to Choose, which I've highlighted here before. Hopefully it will reappear on Google Video again soon.

Update: The Financial Times has a great biography up already.

Update: Some folks don't know about Friedman and withholding. This article explains it best.

Josh Poulson

Posted in category “Business” Thursday, Nov 16 2006 09:35 AM | Permalink | No comments | No trackbacks

According to the Wall Street Journal and TechCrunch, the “do no evil” company that self-censors content for Chinese customers is in talks to buy a video service that censors content for liberals. Rumored valuation is $1.6B.

10/9 Update: The WSJ says the $1.65B deal will be announced after the market closes today.

10/9 After Market Close Update: It's a done deal. Reportedly YouTube will remain relatively independent within the Google hegemony. No news on whether YouTube will cease “doing evil.”

When the acquisition is complete, YouTube will retain its distinct brand identity, strengthening and complementing Google’s own fast-growing video business. YouTube will continue to be based in San Bruno, CA, and all YouTube employees will remain with the company. With Google’s technology, advertiser relationships and global reach, YouTube will continue to build on its success as one of the world's most popular services for video entertainment.

This does not bode well for a lack of evil:

The separate agreements with CBS, Vivendi's Universal Music Group and Sony BMG Music Entertainment come less than a month after YouTube reached a deal with Warner Music Group Corp. On Friday, Google was reported to be in talks to acquire the video site for $1.6 billion.

So, now we have “fake but accurate” CBS and “rootkit” Sony in the mix with “no gun rights” CNN/Time-Warner.

Do I have any more high-tech bridges I can burn in this posting?

Josh Poulson

Posted in category “Business” Friday, Oct 6 2006 08:43 AM | Permalink | No comments | No trackbacks

Primarily because I read Harvard Business Review and Harvard Management Update I recently checked out HBR IdeaCast, Harvard Business Review's experiment with Podcasting. I'm an infrequent reader of another Harvard-related experiment, HBS Working Knowledge, as well.

HBR is not entirely new to podcasting, however, as they have been publishing key excerpts of both of the above publications through Audible.com but it appears that Audible may have been doing the lion's share of the work for them.

The first six episodes have been oddly named, with a hodgepodge of Artist, Album, and Genre settings, making them hard to find in my list of publications on iTunes. Also, as an iTunes Podcast, several of the items were truncated by iTunes's pathetic downloading system. I resorted to going directly to the HBR IdeaCast page and downloading the items directly with FlashGot. When Audible delivers my content through iTunes, I don't have this problem although I've seen it with other podcasts.

The content has also been a tad disappointing for someone that gets HBR and HMU. It's sometimes a rehash, and sometimes a repeat, of information I already have! Such is life, I suppose, since this is free and those other items are paid by subscription. The web page above, however, is a poor promotional tool. I hope that once they clean it up it will be as professional as the other products that come out of Harvard Business Review.

HBS Working Knowledge, in contrast, has improved their look and emails me important new articles as they arrive. I'm hoping that the material that was going into the Harvard Negotiation Newsletter (no longer available through my subscription) migrates there.

Josh Poulson

Posted in category “Business” Saturday, Jul 8 2006 10:04 AM | Permalink | No comments | No trackbacks

Eben Moglen's 6/6/06 Keynote for the Red Hat Summit is a must hear. I wish they had posted a transcript.

Josh Poulson

Posted in category “Business, Linux, Politics” Friday, Jun 9 2006 12:58 PM | Permalink | No comments | No trackbacks

Today's Wall Street Journal has an opinion piece about how many public firms have been moving to private equity, despite the expenses and other problems. The piece indicates a drive to private firms has been the ready availability of capital here (hedge funds and other private equity firms have impressive returns) and avoidance of Sarbanes-Oxley reporting requirements.

Let's look at it from the other side. Startups often get Angel and VC money to get going (private equity) so what is the impetus to finally IPO? The primary reason to IPO is to let the Angels and VCs get their money back out of the investment, but now it looks like rolling over into private equity is the way to go. A smart VC would have a system for performing this rollover and for prepping the company for this eventuality. A smart hedge fund would now fund early startups, VC rounds, and mature private firms all under one umbrella.

Looking at Vonage's IPO it was a disaster for them to go public. If they had done a well-structured and prepared private equity deal it might have gone a great deal better. I am a Vonage customer and was given the option to go in on the IPO, but it didn't look good for me. (I'm focused on building equity in the house at the moment.)

It will be interesting to see if there's a correction that swings the pendulum away from the over-regulation of Sarbanes-Oxley, and whether some firms grow for decades without ever going public. However, there seems to be an incredible inertia that drives regulation and never erodes it.

Josh Poulson

Posted in category “Business” Saturday, Jun 3 2006 11:10 AM | Permalink | No comments | No trackbacks

CNN is running a feature covering 2005's “101 Dumbest Moments in Business”, worth reading if you need a giggle.

Some of my favorites:

18. Perhaps they should change the motto to “Don't be stupid.”

New Google employee Mark Jen adds a post to his blog in which he says he spent his first day in an HR presentation about “nothing in particular.” Apparently, Jen snoozed through the company's strict disclosure rules. In a subsequent post, he reveals that the company expects unprecedented revenues and profit growth in 2005, projections that Google has yet to share with Wall Street. Jen soon receives another presentation from HR: a pink slip.

38. Jeez, it's just a little beeping noise. Don't go having a heart attack.

In June, Guidant recalls 50,000 heart defibrillators—about 38,600 of them already implanted in people's chests—that might, in rare cases, short-circuit when they're supposed to deliver vital electrical jolts. The recall comes after the devices were reported to have failed at least 45 times, including two instances in which the patients died. Guidant fixed the flaw in devices made after mid-2002 but neglected to inform doctors and continued to sell units produced before the fix. The recall advises patients that, should the device malfunction, it will emit a beeping noise, at which point they should contact their doctors or head to an emergency room.

45. May I see my ID?

In February, ChoicePoint—the self-proclaimed “leading provider of identification and credential verification services”—admits that it sold the personal data of 145,000 people to a number of unauthorized recipients, including an identity-theft ring in Los Angeles. ChoicePoint thoughtfully offers the victims a free credit report—but still makes them pay to see the detailed information that was provided to the criminals. The incident kicks up an identity-theft furor serious enough to draw congressional hearings; the company later reports the incident cost it $21 million.

51. How much extra does it cost to have the telemarketers join our loved ones in the great beyond?

The Direct Marketing Association rolls out a Deceased Do-Not-Contact list to stop calls to dead relatives. The fee for preventing telemarketers from reaching to the grave: $1 per person.

64. Told you we shouldn't have rented that list from the Department of Homeland Security.

Blaming a mailing-list vendor for providing bad information, JPMorgan Chase apologizes for sending a form letter about its credit card services to an Arab American man in California addressed to “Palestinian Bomber.”

66. No late fees. Honest. Sort of.

In January, Blockbuster kicks off a “no late fees” policy. The catch? If customers keep their movies more than a week past the due date, their credit cards are charged for the full purchase price; when they return the items, their refund comes minus a “restocking fee.” By March the company settles with 47 states for $630,000 and agrees to pay refunds to consumers who felt misled.

69. The irony is rich. Shareholders, alas, are not.

In June, H&R Block announces a review of its recent financial statements, estimating it will find discrepancies in its favor of about $19 million. Two months later it reveals that the review found $77 million in errors—in the other direction. The company explains that it had “insufficient resources” to identify and report complex transactions in its corporate tax accounting.

94. Thus giving a whole new meaning to “crash-test dummies.”

After a live demonstration of the radar-powered automatic braking system in Mercedes-Benz's new S-Class sedans turns into a nationally televised three-car pileup, the company claims that the steel walls of the safety center where the test took place interfered with the radar and confounded the system. An investigation by the Stern TV network, however, shows that the demonstration was staged (albeit poorly). Mercedes later admits it knew all along that the system would not work inside the safety center and had enlisted the vehicle's driver to “simulate” the experience.

Make sure you check it out.

Josh Poulson

Posted in category “Business” Thursday, Jan 26 2006 06:41 AM | Permalink | 1 comment | No trackbacks

Via Signal vs. Noise I found Guy Kawasaki's latest piece, “The Top Ten Lies of Entrepreneurs.” This is a great list:

I've encountered thoughts like these reading through business plans in my own preparations for finishing school, and there have certainly been plenty of similar lists I've seen on the various VC blogs and in the book The Monk and the Riddle by Randy Komisar with Kent Lineback. Perhaps these are obvious but they deserve restating for people that think they're immune to this.

What's more important about this latest top ten list is the commentary by Guy and Jason Fried's “Guy Gets It Right” post at Signal vs. Noise. Guy collects what his response would be if he was the VC listening to the pitch and gives some good advice. Jason's advice is similar.

I've not had a plan torn apart by a VC, yet, but I've watched others tear apart presentations. I'm not sure I could offer any advice over and above the list of don'ts above. Perhaps I should mention a list of dos:

There you have it. I'm not sure I added anything that was not also obvious, but maybe it's good to say it all again.

Amazon.com links:

Josh Poulson

Posted in category “Business” Monday, Jan 9 2006 08:25 AM | Permalink | No comments | No trackbacks

Bill Gates, currently showing his face at CES keynote, has cited IBM as the biggest threat to Microsoft, surpassing Google and Apple:

“The biggest company in the computer industry by far is IBM. They have the four times the employees that I have, way more revenues than I have. IBM has always been our biggest competitor. The press just doesn't like to write about IBM,” said Gates.

Don't I like to hear it? After all, IBM is the biggest proponent of open standards in the world, too.

Josh Poulson

Posted in category “Business” Thursday, Jan 5 2006 10:35 AM | Permalink | No comments | No trackbacks

Joel Spolsky over at Fog Creek Software has developed a Software Management Training Program which hopes to be practical and comprehensive:

Thus: how do we develop the next generation of managers? We don't really want to hire MBAs, because there's too much evidence that MBAs substitute book-learnin' for common sense or experience. We'd much rather hire someone who created and ran a profitable lemonade stand than someone who has taken two years of finance courses at Harvard, especially since the Harvard MBA is going to think he knows a lot more than he really does.

I've been watching for more developments. Recently Joel published the reading list. I have a lot of the ones listed in my library, and I even have some of them in MP3 format. There's a few more that I need to look into.

The real question is “What is missing?” There are a few in my opinion.

The Chasm Companion is a step beyond the recommended Fog Creek-recommended Crossing the Chasm. It's focused on implementation issues, and less about the chasm stage of the Technology Adoption Lifecycle.

There needs to be a little bit more emphasis on strategy in a management training program. I see Competing on Internet Time on the list, but I think there are better choices. Competing on the Edge delves into the trade-offs of high-tech business strategies and the timing of their implementation. Blue Ocean Strategy looks into the strategy of innovation and where best to compete.

It's important to understand getting projects done, especially software projects.

Patrick Lencioni's leadership fables, and the related field guide on teams, are important reading for understanding how teams work and the priorities of a team leader. Any of them are a great leap beyond the suggested One Minute Manager.

I found Reframing Organizations an important text on organizational theory as well.

Finally, I don't see any books on Writing, Business Law, Finance or Valuation, but I suspect that's far afield. If they are needed, I'm sure others will suggest appropriate texts.

Josh Poulson

Posted in category “Business” Monday, Nov 28 2005 12:00 PM | Permalink | No comments | No trackbacks

Last night the December issue of Harvard Business Review landed in my inbox and it had an excellent article by Geoffrey Moore called “Strategy and Your Stronger Hand.” The main idea of the article is that businesses have to choose between being supporting “Complex Systems” or a “Volume Operations.” When companies try to straddle this dilemma, they cause problems for themselves.

The best strategic moves for a company are ones that supplement rather than complement the company's current dominant business model. This is a form of saying “stick to your knitting” but requires a new understanding of the knitting involved. A better metaphor would be to say that companies should favor their dominant hand.

This is an interesting insight, because I have perceived that an important decision for a business is where along the continuum from products to services companies wish to operate. Inherent in that choice was whether to handle volume operations oneself or to outsource it and focus on adding value in some other way.

Moore's article indicates that it's a more complex choice. Does your organization want to seek out customers and make complex custom solutions for them (the example used was IBM Global Services, the consulting arm of IBM) or does it wish to deliver products for thousands or millions of customers making a small amount of money on each sale? IBM shows up on the opposite hand of Dell. Obviously both companies make money, but they do it in quite different ways. Also, each company rises and falls as new innovations take hold in the marketplace.

Moore indicates that these two models are the only ones that scale to large organizations. There are other models when it comes to small businesses, but at some point you must choose between being a McDonald's or being Ruth's Chris. It's very hard to be both. In another vein, at some point your custom-built PC business needs to decide between making custom solutions (hand-built servers for specific purposes, tied with maintenance and support) for a small number of customers or mass-producing the most popular PC designs for a large marketplace.

Moore concentrates on the various choices that result from the selection of the model, and the implications for all functions of the organization. He points out the negative consequences of acquiring an organization with the opposite handedness (recall Compaq merging with DEC, for example). To me, it seems like he's got another book in the works, because he is clearly laying out a plan of attack for either hand, and the mixed model of trying to do both sets of activities in one organization. We'll have to see if it's another Crossing the Chasm or Inside the Tornado.

It's a great article, and with HBR you can usually get reprints in a few months. For this one, look for Reprint R0512C or 2394 on Harvard Business School Press's website.

Amazon.com links:

Josh Poulson

Posted in category “Business” Sunday, Nov 27 2005 09:55 AM | Permalink | No comments | No trackbacks

Peter F. Drucker, writer of a multitude of management books and articles, has passed on. The Wall Street Journal, which published many of his articles, deeply respected him:

Mr. Drucker invented management—not as a practice, but as a field of study. It was he who first asked managers to decentralize their operations and treat their employees like humans—in the 1940s. The concept of “knowledge work” is his coinage, from the 1950s.

I have to agree. While many companies are still adopting ideas he pioneered, his contributions led us away from the dehumanizing “scientific management” of Frederick Taylor and towards a more synergistic relationship between people and business.

President Bush awarded Drucker the Congressional Medal of Freedom in 2002.

The Financial Times also grieved his passing:

Drucker's reputation, among many practitioners and theorists alike, as the father of post-war management went back to two of his early works, Concept of the Corporation in 1946, and The Practice of Management in 1954.

The former, a study of the workings of General Motors, was the first detailed account of the way a large company operated. The latter contained pathfinding work on such varied topics as the key role of marketing; the importance of clear objectives, both for the corporation and for the manager; and the need to balance long-term strategy and innovation against short-term performance.

This early work laid the foundation for such basic principles of modern business as asking: “What business are we in, and who are our customers?” It dealt with the recruitment and development of executives, the proper role of boards of directors, the defence of profits as an essential foundation of future survival, and the development of the responsible and productive worker.

Of Drucker's books, I've only read a few, but I've liked them all. I could only wish to have 95 years of groundbreaking work under my belt. I'm having enough of a hard time just reading everyone who came before me.

Amazon.com links:

Josh Poulson

Posted in category “Business” Saturday, Nov 12 2005 08:51 AM | Permalink | No comments | No trackbacks

Details on progressive intent with the minimum wage from the Marginal Revolution:

Unlike today's progressives, the originals understood that minimum wages for women would put women out of work - that was the point and the more unemployment of women the better!

They go on to recommend Tim Leonard's paper “Protecting Family and Race: The Progressive Case for Regulating Women's Work” to learn the secret history of the minimum wage.

It's pretty clear that government regulation that forces employers to pay a minimum amount will limit the number of people employers will hire, but this idea that the original intention was to limit the penetration of women into the workforce is new to me.

(Those who do not know the history of the word “staff” will take longer to get the pun.)

Josh Poulson

Posted in category “Business, Politics” Tuesday, Oct 25 2005 05:09 PM | Permalink | No comments | No trackbacks

Yesterday my employer did another in a long series of firsts by coming out against the use of genetic data of its employees.

Dear IBMer:

During our lifetimes, the practice of medicine and society's approach to healthcare have changed in fundamental ways. But what lies ahead—perhaps in the next decade alone—seems likely to eclipse that progress dramatically.

Along with any change in an important area of science or society, new and often difficult policy questions inevitably arise. And that's uniquely so for healthcare. Business, government and the research community have a responsibility to address these issues. I am writing today to tell you about an important step that IBM is taking to do so.

Of all the work now taking place across the life sciences, none perhaps has the transforming potential of the pioneering efforts to unlock the secrets of the human genome. IBM is already engaged in many of the technology innovations springing from the revolution in genetics and IT—from “information-based medicine” (which seeks to transform care by marrying genomics with clinical treatment); to our Genographic Project, where we're helping National Geographic to map the scientific history of our genes' migration; to the innovation flowing from our Blue Gene supercomputer.

This work is enormously promising—but it also raises very significant issues, especially in the areas of privacy and security. The opportunity the world has to improve life in the century ahead through genomics-driven, personalized medicine and preventive care will only be realized fully if it also takes into account the protection of genetic privacy. We must make this a priority now.

For that reason, I have signed a revision of IBM's equal opportunity policy, first published by Thomas J. Watson, Jr., in 1953. IBM is formally committing that it will not use genetic information in its employment decisions, a policy we believe is the first of its kind for a major corporation. You should know that IBM does not actively seek to collect genetic information—but at times, and increasingly in the future, employees or their family members may choose to share it, for example, in order to facilitate participation in information-based wellness programs. In anticipation of such circumstances and other situations that we cannot fully anticipate, we are today establishing that business activities such as hiring, promotion and compensation of employees will be conducted without regard to a person's genetics.

It has been IBM's long-standing policy not to discriminate against people because of their heritage or who they are. A person's genetic makeup may be the most fundamental expression of both. So, we are taking this step today because it is the right thing to do—for the sake of the innovation that lies just over the horizon, and because it is entirely consistent with our values and with who we are as a company.

Samuel J. Palmisano

Chairman and Chief Executive Officer

There have been news stories about this, but I figure people would actually like to know what the memo said.

Josh Poulson

Posted in category “Business” Tuesday, Oct 11 2005 09:42 AM | Permalink | 2 comments | No trackbacks

The Real Story of Informix Software and Phil White should prove to be an interesting book. I was with Informix from August of 1997 until the database business of Informix was bought by IBM in 2001. I joined just after Phil White had left the company under a cloud due to needed restatements of earnings that changed the very positive Informix Software from a big seller to a slow loser. Great products, but something happened to suck its life away.

From the Sterling Hoffman newletter the author Steve W. Martin gives us this tidbit:

If you had bought $32,000 worth of Informix stock at its 1991 low you would have made $1 million in just two short years. The incredible success of Informix Software and its growth to $1 billion in sales by the end of 1996 should rightly be credited to Phil White, Informix's President, CEO, and Chairman of the Board. Although White engineered one of the most stunning turnarounds in Silicon Valley history, he was also the person responsible for its shocking collapse in 1997.

He makes it sound like I joined a sinking ship. However, I believed pretty strongly in Informix's products, and worked to make them even better. Such is life, eh? While there was a shocking collapse before I joined in 1997, it was well on its way to recovering its lost ground. I believe the later collapse had other causes, key of which was the Ascential acquisition.

More on this after I read the book some day. (School is busy again.)

Amazon.com links:

Josh Poulson

Posted in category “Business” Monday, Oct 3 2005 01:46 PM | Permalink | No comments | No trackbacks

10: Your annual breast exam is done at Hooters.

9: Directions to your Doctor's office include, “Take a left when you enter the trailer park.”

8: The tongue depressors taste faintly of Fudgesicles.

7: The only proctologist in the plan is “Gus” from Roto-Rooter.

6: The only item listed under Preventative Care Coverage is “An apple a day.”

5: Your primary care physician is wearing the pants you gave to Goodwill last month.

4: “The patient is responsible for 200% of out of network charges,” is not a typographical error.

3: The only expense covered 100% is “embalming.”

2: Your Prozac comes in different colors with little M's on them.

And the number one sign your employer has joined a very cheap health plan:

1: You ask for Viagra, and they give you a Popsicle stick and duct tape.

From Grandma Lissa…

Josh Poulson

Posted in category “Business” Friday, Aug 19 2005 03:26 PM | Permalink | No comments | No trackbacks

The EU parliament overwhelmingly rejected a sweeping software patent law by 648 against, 14 for and 18 abstentions. It is unlikely that a new attempt will be made for some time.

The bill had been loaded down with 170 amendments intended to limit what could be patented, producing an unlikely coalition of both open source and patent advocates. Many hope that this outcome will curtail the current practice of seeking patents on software (from the Wall Street Journal):

The Greens who led the opposition said they hoped the European patent offices would now take a more restrictive view on patenting software. “MEPs have given the software patents directive a third class burial,” said Eva Lichtenberger, an Austrian parliamentarian who led the party's effort on the bill. Patent officenrs “must halt its current practice of granting patents for software, a practice which there is no legal basis.” They “must think now about creating policies that benefit not only big business.”

Supporters of the bill hope that this backlash will be avoided. “As I've always said it is better to have no directive than to have a bad directive,” said Sharon Bowles, Liberal Democrat and a patent attorney.

You can read more about it here and here.

I am a little torn on this issue. On one side I do think that software inventors deserve a little reward for their hard work, and copyright doesn't seem to be enough. On the other side, I know that little companies can be ruined by getting hauled into patent courts, even if they have all the merits on their side. There has to be an easier way.

Josh Poulson

Posted in category “Business” Wednesday, Jul 6 2005 08:49 AM | Permalink | No comments | No trackbacks

While my own network at linkedin.com is only 88 direct people and 1.7 million by the fourth degree, last night they signed up their 3 millionth user.

Linkedin is a service that allows you to network with your trusted colleagues and friends as a way to help you get referrals for either jobs or businesses. I've been working at reconnecting with folks I've worked with up to twenty years ago. It's amazing how many email addresses you can find when you have archives going back to the mid-90's, but most of those addresses are bogus. If it wasn't for google, I'd have a hard time finding some people.

I have not yet convinced Misty to make use of Linkedin to stay connected with her friends in nursing, and my dad is too deep in the throes of the infamous bar exam to spend time on it, but some of my colleagues have picked it up and run with it.

I like Linkedin, though. It's already found me a couple of job opportunities and referrals that I liked.

Josh Poulson

Posted in category “Business” Friday, Jun 24 2005 06:55 AM | Permalink | No comments | No trackbacks

BusinessWeek includes pieces from S&P sometimes, today they had a item about mergers in the software industry. What I found more interesting, though, was their forward-looking predictions. According to Standard & Poor's, there are too many players trying to sell into the enterprise software market:

In our opinion, there was, and still is, too much capacity in the industry, particularly in enterprise software. This overcapacity has created a great deal of pressure, in our view, for enterprise software providers to discount their products, particularly at the end of any given quarter.

As a result, customers are turning to suites:

Additional reasons for further consolidation, in our view, are that the software industry is growing in the low- to mid-single digits, as opposed to the double-digit growth of the 1990s, and customers are starting to limit the number of outside vendors they deal with. In this environment, we believe the larger suite providers are better positioned to gain market share.

That's an interesting observation. When such things happen it's because the market has become saturated and buyers are treating such products as commodities. While it may be the case that ERP tools are commodities, the recent experiences I've had in my New Product Development course lead me to believe there are still things to be done in the PDM space.

My recent experiences with PeopleSoft tools make me wonder how those guys are still in business. IBM and Intel use their tools for job searching, and they stink! If that's the general public face of PeopleSoft they are not long for the world.

Josh Poulson

Posted in category “Business” Monday, May 9 2005 10:08 AM | Permalink | No comments | No trackbacks

Standard and Poors are dropping their ratings for GM and Ford debt to “junk” status, making it much harder (therefore more expensive, as the expected return will be much higher) for them to issue bonds. This new rating moves them out of “investment” grade and into the realm of speculation if you sell them capital.

I wonder how much this has to do with the climbing cost of gasoline. The fact that Ford is in the mix indicates, to me, a failure of their Escape hybrid launch. GM has had cost troubles for years, so that's less of a surprise.

I drive a Dodge, and I've been looking at the new Charger and the Chrysler 300C for a while now.

Josh Poulson

Posted in category “Business” Thursday, May 5 2005 09:56 AM | Permalink | No comments | No trackbacks

The Federal Reserve raised the rates a quarter point today, the eighth time in a row they've raised rates. The Federal Funds Target Rate is now 3%. That was expected.

What wasn't expected was a late-day change to the released report adding this sentence to the second paragraph:

Longer-term inflation expectations remain well contained.

This statement was included in the four previous statements, and its omission from today's report was an error. The street had already started buzzing because it was missing…

Who says little words don't count?

Observers have watched the Fed reports closely to spot indicators of deflated consumer confidence or inflated consumer prices. Every sentence has a clear meaning to the analysts on Wall Street.

Josh Poulson

Posted in category “Business” Tuesday, May 3 2005 02:19 PM | Permalink | 1 comment | No trackbacks

A couple weeks ago someone from Dell called us up and said that Comcast indicated that broadband was available in our area, and as valued Dell customers were we interested? Regular readers will note that I've been using satellite broadband from DirecWay for a couple years now and it's not exactly as good as the DSL I used to have in downtown Portland. In fact, the one second plus latency of the system is miserable for VPN.

Well, we jumped at the chance, especially when they said that it was only a $50 fee for “professional installation.” They needed some information for renting the modem and so on, but we went ahead.

Later, supposedly someone from Comcast called us, but we missed the call. So my wife called Comcast up and tried to figure out where we were in the system. They had no record of us and, in fact, the closest address that could get broadband from them was over two miles away.

So, I have to decide now between the possibilities that someone in Dell is both an aggressive seller and an incompetent executor or that I just got scammed by a pretty smart cookie. All the ticket information I took down, except the 800 numbers to call, are bogus, so I'm leaning towards “scam.” I don't see any charges on my credit card, yet, so I'm still not sure what the deal is.

Anyone else out there get nailed by this?

Josh Poulson

Posted in category “Business” Thursday, Apr 28 2005 09:33 AM | Permalink | 5 comments | No trackbacks

Trust the client operating system platform monopolist to demonstrate vaporware:

Microsoft on Monday plans to show off pretty much the dream portable computer—a tiny tablet computer as thin as 10 sheets of paper with a camera, a battery that lasts all day and a price of about $800.

The only problem is that it's still several years from reality.

Microsoft commissioned the 6-inch-screen prototype, but still doesn't know exactly when it will be commercially feasible. It will probably come at least a year or two after the arrival of Longhorn, the new version of Windows set to ship at the end of next year.

It's always fun to demonstrate something cool, but why talk about a price point when you're years away from shipping in volume? Well, in order to stifle the development efforts of your competitors, that's why.

Today Microsoft finally ships a 64-bit operating system platform so many years after it killed its DEC Alpha program. I'll be the first to admit I as enabling 64-bit database engines over six years ago when I was at Informix, and I was hardly the first to do it. About time Microsoft joined the party. We'll see if they follow up with a 64-bit SQL Server right away.

Josh Poulson

Posted in category “Business” Monday, Apr 25 2005 09:44 AM | Permalink | No comments | No trackbacks

Groklaw has collected a page full of patent resources. There's far more there than you may really want to read, but it's good to look through.

Josh Poulson

Posted in category “Business” Friday, Apr 22 2005 12:25 PM | Permalink | No comments | No trackbacks

Watts S. Humphrey was awarded the National Medal of Technology for his contributions to the discipline of Software Engineering. He is best known for the Software Capability Maturity Model (SW-CMM), the Personal Software Process and the Team Software Process.

The National Medal of Technology is the highest honor awarded by the President of the United States to America's leading innovators. A formal ceremony took place March 14, 2005, at the White House.

The National Medal of Technology is given to individuals, teams, and/or companies for their outstanding contributions to the nation's economic, environmental, and social well-being through the development and commercialization of technology products, processes, and concepts; technological innovation; and development of the nation's technological expertise.

Humphrey's books were always clearly written but were considered “overhead” by far too many programmers and considered “userful” by far too few software engineers. It's good to see that he has been recognized for pushing the limits of software quality, even if most shops seem to support the idea of “good enough.”

(Hat tip to Grady Booch.)

Amazon.com links:

Josh Poulson

Posted in category “Business” Tuesday, Apr 5 2005 01:22 PM | Permalink | No comments | No trackbacks

I got this information from an IBM information page, but I summarized it myself.

The Labor Relations Institute of New York has done repeated studies on what employees want and what managers think employees want. The results are typically different:

What managers think employees want:

- Good wages

- Job Security

- Promotion and growth opportunities

- Good working conditions

- Interesting work

- Personal loyalty to workers

- Tactful discipline

- Full appreciation for work done

- Sympathetic understanding of personal problems

- Feeling “in” on things

What employees say they want:

- Full appreciation for work done

- Feeling “in” on things

- Sympathetic understanding of personal problems

- Job security

- Good wages

- Interesting work

- Promotion and growth opportunities

- Personal loyalty to workers

- Good working conditions

- Tactful discipline

What would really be interesting to see is a study that compared what employees say they want and what they actually respond to. Well, actually, there's been a lot of studies about that. Everyone wants to feel like they are part of something bigger than themselves and managers should endeavor to make sure employees understand, influence and are a part of the “big picture.”

Is that really so hard?

I think that understanding should be applied to citizens, too. Citizens want to understand, influence and be a part of the big picture for their town, county, state and country too. They want their voice to be heard. But I wonder. Do they really make good decisions?

I'll leave that question open.

Josh Poulson

Posted in category “Business” Wednesday, Mar 23 2005 09:44 AM | Permalink | No comments | No trackbacks

Yesterday all the focus was on the Italian journalist who was wounded (and her protection agent was killed) when the engine block was shot out of their car. However, some good news has come down the pike.

The Labor Department reported Friday that U.S. nonfarm payrolls grew by 262,000 last month after a downwardly revised 132,000-job increase in January. But December's payroll reading was marked up to an increase of 155,000 jobs from the earlier 133,000 jobs, leaving a net gain of 8,000 jobs for the December-January period.

Also, more people started looking for jobs:

The unemployment rate rose to 5.4% in February, up from January's 5.2%. The unemployment rate is calculated using a separate statistical survey from the payroll figures. The household survey from which the jobless rate is drawn showed a 97,000-job drop in employment at the same time that the civilian labor force grew by roughly 153,000.

The market had a great day yesterday with the Dow Jones index rising almost a full percent, and NASDAQ coming up six tenths of a percent. I would like to think it was responding to good news about employment (and the relative stability of inflation) rather than celebrating the return of Martha Stewart.

So what bad news balances this out? Gas prices are definitely on the rise. Oil has made it to $52 a barrel now, and could run up as high as $60 in a repeat of last year's spike. This one hits close to home for me, since I have a 38 mile commute. (It takes a long commute to get fifteen acres to yourself without having to amass a fortune first.)

Josh Poulson

Posted in category “Business” Saturday, Mar 5 2005 07:47 AM | Permalink | No comments | No trackbacks

Walmart wants to come into Beaverton, Oregon in a little community called Cedar Mills. It's near a high-rent district called Forest Heights, but it's also near a major interchange (US 26) and is in the middle of suburban Portland. On the radio this morning I heard a comment that “no one that lives here would shop there.”

That's a goofy argument against a store from a company that leverages its size to bludgeon suppliers and offer the lowest average prices possible. One has already learned that becoming a millionaire (a common fable in Forest Heights) requires saving money rather than spending it. Walmart is a good way to do that. Don't those rich people in Forest Heights want to keep their money?

Even if no one in Forest Heights shopped at Walmart, all the folks in the valley might be interested. After all, this is suburbia down here where the oxygen isn't so thin.

I've never really understood all the fights against Walmart. Sure, it competes handily against little mom and pop stores, but stores that sell commodities are well aware of the damage of price wars. They should focus on what value they can add to demand those higher prices rather than relying on legal and community pressure to keep out the large chain stores.

Josh Poulson

Posted in category “Business” Tuesday, Mar 1 2005 09:21 AM | Permalink | 6 comments | No trackbacks

Today's Financial Times has an article about the predatory behavior of Trading Technologies, a firm that has been awarded two software patents in the UK, presumably based on its US patents 6,772,132, 6,766,304 and 6,828,968. I couldn't find the European patents in question. These patents are broad enough that many entry-order systems could be covered by the claims. The article indicates that Trading Technologies also has eighty more patents in the pipeline.

While Pamela Jones at Groklaw laments the prodigious number of software patents in Trading Technologies pipeline, it is also important to look at the effect on the financial markets.

One of the patents appears to describe any trading order entry system that displays market depth (essentially the difference between highest bid and lowest ask prices) and allows a trader to select (with one click) a region of prices in which to place an order it could affect a large number of home-grown or commercial trading software. The next patent describes the fancy table that is used to describe the market. The third appears to patent the idea of using multiple colors to make a more readable chart, although the added value comes from specifying additional colors to parameters of the table on the fly.

So why do patents on visual analysis and order entry tools matter to us? Because Trading Technologies is actively suing and getting settlements from other trading software companies:

TT… has won damages for patent infringement from the Chicago-based brokerages Kingstree Trading and Goldenberg Hehmeyer, both of which settled remarkably quickly.

The independent software vendor has launched another case of patent infringement against eSpeed, the electronic arm of the US brokerage Cantor Fitzgerald. Earlier this month the judge, in an interim decision, made comments favourable to TT’s case, saying that eSpeed had not raised substantial questions against it.

So, that would make trading software with useful analysis tools and order entry systems a bit more expensive. Is there more than that?

TT has proposed to the four main futures exchanges—two in Chicago, plus Euronext.Liffe and Eurex—that it should be paid a fee for not starting patent infringement cases against them. It has taken out full-page advertisements in the Financial Times and The Wall Street Journal setting out its argument in an open letter. TT wants 2½ cents for each side of a trade, which would amount to revenue of about $130m annually.

That's the key bottom line. It's trying to leverage a patent that holds for a couple decades into a permanent licensing agreement. “Pay us five cents a future trade forever, get sued, or not be able to show market depth with one-click trade orders for 17 years!”

In addition, there's a time limit on the decision.

TT’s open letter said that if the exchanges rejected its request for 2½ cents per trade, it would instead raise the price of its software and step up its litigation programme. But it also said it might accept a takeover offer if the right offer emerged.

Well, you never get rich without being brazen, but these guys are playing hardball. You can read their open letter to the future markets here.

So will futures trading be hampered by software patents, cost more because of software patents, or will the European Union reject software patents and move the future of the futures markets to foreign soil because US Patent Law is so forgiving of software patents? The clock is ticking…

Josh Poulson

Posted in category “Business” Thursday, Feb 24 2005 09:33 AM | Permalink | No comments | No trackbacks

Via Walter Olsen at Overlawyered he find this article at law.com.

A federal judge in Fresno, Calif., has ordered the entire 80-lawyer firm of Lozano Smith back to school for a refresher course in ethics as a sanction for repeated misrepresentation of facts and the law in a dispute over aid for a learning-disabled student.

Apparently the behavior of the firm was so egregious that it earned a significant sanction:

In a scorching 83-page opinion, Wanger said Lozano Smith, its lead attorney in the case, Elaine Yama, and the district engaged in “repeated misstatements of the record, frivolous objections to plaintiff's statement of facts, and repeated mischaracterizations of the law.”

In his highly unusual sanction, Wanger ordered every one of the firm's 80 lawyers in seven cities to undergo six hours of ethics training and ordered Yama to take 20 hours.

It's not often I see so uplifting a court opinion. Not only will this firm have a hard time doing any business with public schools in California, it will have trouble getting respect in court. Elaine Yama may not be with the firm any more, but apparently this has been a long-standing problem with the firm as whole:

“The Lozano law firm, in my opinion, has established an indisputable culture of deliberate, systematic institutional abuse across California,” said Jo Rupert Behm, past president of the California Learning Disabilities Association.

However, one always wonders what law firms do for revenge…

Josh Poulson

Posted in category “Business” Monday, Feb 21 2005 10:40 PM | Permalink | No comments | No trackbacks

As a continuation of ideas I picked up in my MST classes, I have been interested in stories about the level of funding of basic research. Yesterday, MIT Technology Review had an article called “Follow the Money” looking into the President's new budget and its effect on basic research funding.

First, the good news.

The appetite of venture capitalists for investing in new technologies is rebounding: in 2004, venture capital financing in the United States was up 8 percent from the year before, following three years of decline.

The resurgence of VC money is an indicator to me that the market is turning around. It is also an indication to me that private funding of basic research is growing in attractiveness. More on that later.

Venture capitalists never entirely stopped investing in companies with technologies just emerging from the lab. But after several years in which high-risk investments were unpopular, many startups developing innovative technologies (especially in such areas as nanotechnology and new genomic approaches to medicine) are starving for capital.

This one I have trouble with. When I was looking into these areas with relation to my coursework we were interested in finding ways to get private firms to leverage the research facilities here in the Pacific Northwest. Much of what we examined was around nanotechnology, especially in relation to microprocessor development. There seemed to be a lot of activity in the firms we examined.

The article goes on to applaud an increase in research funding, even if 80% was targeted at Defense and Homeland Security projects. It did point out that the National Science Foundation had “the first cut in NSF's budget since 1996.” and the National Institutes of Health only had a 1.8% increase. To me, that might encourage the firms that rely on that basic research to fund more of it.

The article does have a point, though. It claims that research funding “has become too skewed toward relatively mature technologies.” That is a serious problem since, to me, funding of basic research makes a lot more sense than funding later stages in the innovation life cycle. ROI from basic research takes decades to quantify, so a broader program to support it makes a lot of sense. ROI for the later stages where technologies are applied and turned into products is easier to calculate because the returns come sooner. Even in the case of defense products, it might be more beneficial to allow private concerns to compete on how efficiently they can create useful solutions rather than funding such activities.

While valuations of later-stage venture-backed startups have begun to bounce back this year, valuations for younger startups have not. In addition, say experts, some venture capitalists are focusing on certain pockets of technology, such as those relevant to homeland security and biodefense, where the focus is more on developing and deploying existing, well-established technologies than on inventing innovative new ones.

So, the VCs have brought more money to the table, but they tend to put it in areas where the risk is lower. That is, if the basic research and even applications of that research are funded by the government, they get to fund the less risky productization of that research. Makes sense to me. The higher the risk factors, the harder it is to identify projects able to adequately cross the hurdle rates demanded by even these less risk-averse investors.

Indeed, the combination of venture capitalists favoring later-stage startups and the continuing trend of large corporations investing less in speculative research is creating an innovation vacuum, according to some experts.

From a Physics perspective, nature (and markets) abhors a vacuum. If there's money to be made in that space and someone can make a good case for it, a firm will arise and VCs will fund them that can take advantage of the need to do this basic work. However, because of the risk, the returns will have to be high. The other factor, in my experience, is that government abhors high realized returns. They tax the snot out of anyone that realizes significant income. A firm that fills this space, therefore, cannot realize income over short periods, but must continually reinvest to incur expenses to bring down its tax liability.

What sort of investor appreciates this sort of capital sink? The long-term one. Are there many of those left?

2004 was a strong year for companies going public; the number of IPOs and the amount of money they raised reached their highest levels since 2000. What’s more, the value of mergers and acquisitions involving venture-backed companies was 76 percent higher than in 2003—all of which means that venture capitalists once again have the prospect of lucrative exit strategies and the motivation to invest in startup companies.

VC's love middle-term projects. Ten years is pretty much their window. So the budget is indeed skewed incorrectly. Let the VCs fund the middle-term Defense and Homeland Security projects that will surely be purchased if threats continue to exist (they will). I agree with this article. The skew of government research grants must be biased towards basic research and away from the shorter-term projects that have caught their interest.

Josh Poulson

Posted in category “Business” Friday, Feb 18 2005 09:58 AM | Permalink | No comments | 1 trackback

The initial flurry of Carly's exit stories yesterday is dwarfed by the prodigious output of armchair quarterbacking this morning. The Wall Street Journal, Business Week, the Economist and even regular news outlets have stories this morning. What caught me by surprise, though, was a piece in today's MIT Technology Review entitled, “Worst. CEO. Ever.”

It's pretty harsh.

There was little love lost between the CEO and the 151,000 HP workers who have, almost consistently since 1999, made hating their boss a very personal, full-time mission.

“When the news was officially announced this morning, people were dancing—literally dancing—around their cubicles,” an employee in the business division writes in an email.

Why is there so much hated of Carly inside the company? After all, the Board of Directors has done nothing to change the strategy that many feel has led to HP's problems. As The Economist is saying today,

The ousting of Ms Fiorina therefore does not automatically mean that a break-up is now likely. The same board that has decided against it three times already, and this week pledged allegiance to HP’s strategy—whatever that is—will now be looking for a new chief executive.

Carly was a key driver of combining businesses inside HP. Recently she drove the merger of the PC and Printer business units, which would hide the poor performance of that division in the profits of the only truly profitable part of the company.

Part of the reason HP is up in the market now is that many feel the key person arguing against a break-up of the company is now gone, and therefore it is likely to split up.

Other may believe that innovation will return as a HP strategy. As MIT Technology Review put it:

Fiorina's obsession with Wall Street pushed much innovation to the side, and eventually led to a rather unsettling change in the HP work environment: the company's very first layoffs. When it was all said and done, 15,000 of the then 85,000 workers found themselves without a job by the end of 2003.

However, if the 80's and 90's taught us anything, one cannot be a lean-mean fighting company and have a culture of entitlement and continuous employment. Carly's head was in the right place in one respect:

“After a period of integration, cost-cutting, returning our businesses to profitability and returning to top line growth, we enter fiscal year 2005 knowing that we have the right strategy, play in the right markets and offer the right portfolio of products and services,” Fiorina writes. “We are now focused on consistency of execution and consistently delivering financial performance, great customer experiences and shareowner value.”

She's right. One has to build shareholder value to make the investors happy. However, it's only one of the many levers of managerial control. One also has to innovate in order to maintain growth long-term. I believe she tipped the balance too far. HP was not about to go bankrupt. It still needed to invest in forward-looking projects as well as cleaning up the bottom line. Apparently the employees agree:

And her reluctance to embrace research and development of emerging technologies, consistently creating new and better markets as only Hewlett-Packard could, alienated her from the company.

According to BusinessWeek's “Inside Story” of the firing of Fiorina, she was good at passion and marketing but lousy at strategy,

Sure, she had dazzled directors and many investors with her passionate work in pushing through the controversial merger with Compaq Computer in 2002. And the immediate integration of the two companies bested expectations, silencing even her fiercest critics. But by late 2003, investors began shifting their focus from the Compaq deal to HP's ebbing position against key competitors IBM and Dell. They bored in on the ragged financial performance that led to the swooning stock price.

“[Fiorina's] good with marketing. She's a good speaker for the company,” says a former HP executive. “But this is a company that doesn't need a statesman. It needs a hands-on operations person.”

The story keeps coming back to execution, specifically the speed at which she needed to change the business. She was slow to fight the incursion of Dell and IBM (who I readily admit working for, although I try to keep their business out of my writing here). She was slow to execute on a possible acquisition of Veritas Software, Inc.

Financial performance is definitely important, compared to the industry:

The management ouster at HP gives the company a chance to rebuild trust with investors. During Fiorina's 21 quarters atop HP, it missed profit expectations eight times. Sure, that's better than the 21 quarters before Fiorina arrived. But it's also more than double the combined misses of IBM and Dell over the same period.

However, Business Week doesn't believe it was just execution that is causing HP's funk, however:

While it's convenient for HP's leaders to blame poor execution for their problems, what ails the company runs much deeper than replacing a few top executives. In enterprise computing, HP has failed to improve its lot. While it is still narrowly holds the market-share lead in storage and in key server markets, including Unix and PC servers, it's losing ground to EMC in storage and Dell and IBM in servers. In some cases, its technology just hasn't kept up. In others, it has made bad bets.

The biggest failure, in my opinion, was Itanium, as I've mentioned here before.

As a result the board talked to her more and more in hopes of getting her to delegate operational activities to her executives and she was reluctant to do so. Remember that she fired three executives for a bad quarter just half a year previously. She also drew some criticism for twice rejecting an opportunity to establish a chief operating officer to handle the tasks of execution. As a result, by not delegating, she took the brunt of the bad year herself.

I think it's telling that HP's CFO, Robert P. Wayman, is now the interim CEO. That indicates to me that the board is interested in shoring up its financial position and hopes that Wayman will execute on what strategy remains at HP. However, it's the perfect person to have in charge if breaking the company up is in the future.

The front runner for replacing Fiorina is Michael A. Capellas, currently running MCI, but notable as the executive that sold Compaq to HP in the first place, and served as a VP for a short while in the giant company. However, we'll have to see if the half a year it takes to find an executive yields fruit or if the company is sliced and diced into smaller, faster, companies that have to struggle to find revenue.

If you're a subscriber and you have a lot of time, the Wall Street Journal has comprehensive coverage of the situation. Me, I need to get back to work.

Update: With a pointer from Prof. Jack Raiton, I discovered a Financial Times article that points out changes in the Board of Directors at HP hastened Fiorina's demise.

Dick Hackborn, the HP director and former executive responsible for creating the company's hugely successful printing business, probably played a key role in the behind-the-scenes manoeuvrings that led up to Carly Fiorina's removal, according to close observers of the company.

So Hackborn was her main source of support, but her other supporters started leaving a year ago:

Other boardroom moves have also served to weaken Ms Fiorina's position. Sam Ginn, who had led the search committee when she was hired and had been one of her staunchest supporters, left the board a year ago, along with Phil Condit, the former Boeing chairman who had also been a supporter. Mr Ginn and Mr Condit had also steered the board's nominating and governance committee, a key inner group with influence over the composition and workings of the board.

Two more changes cemented the deal. First, she lost another supporter:

Recent signs pointed to a more rapid shift in the balance of power in the boardroom that finally stripped Ms Fiorina of support. Sandy Litvack, who as a former general counsel of Walt Disney had shown strident public support for embattled CEOs in the past, quit unexpectedly as an HP director at the start of this month - just weeks before he was due to retire.

…and she gained an enemy:

Then this Monday, the day before Ms Fiorina was dismissed, Tom Perkins, a former Compaq director and one of Silicon Valley's most eminent venture capitalists, rejoined the HP board a year after retiring allegedly for age reasons.

You have to keep the board happy if you want to continue being a CEO. When the board changes you have to move fast. “Moving fast” was not at the top of the list of Carly's strong points.

Josh Poulson

Posted in category “Business” Thursday, Feb 10 2005 08:37 AM | Permalink | 1 comment | No trackbacks

BusinessWeek Online has an article, “After Sarbanes-Oxley, XBRL?” discussing Extensible Business Reporting Language (XBRL) and its effects on the financial reporting industry.

As a little bit of background, XBRL was announced by the American Institute of Certified Public Accountants (AICPA) jointly with Reuters and over thirty other organizations as a standard way to release computer-readable financial statements to the public. What is it's key value? The ability to determine the source of information in the released documents.

XBRL tags financial information so it, too, can be tracked, from the first interactions with vendors, to reports submitted to various operating divisions within a company, and finally to become part of a consolidated earnings release.

That's the core technology. What's the promise?

Eventually, XBRL will be the foundation for a whole new generation of financially oriented Web services that will make it easier for regulators to check for problems in financial data, executives to compare their company to competitors, and analysts to identify the best-performing stocks.

While it's a long time before modern financial data movers reach those ethereal heights, online services such as Edgar Online are offering tools to work with the data and software vendors like Rivet Software offer tools to sift financial documents for data that can be transformed into XBRL.

The adoption of the XBRL standard has not been made mandatory by the SEC, and the competition is already nervous. Standardization signifies a significant market change for companies like Standard & Poor's with their Compustat offering. S&P does their own data extraction and analysis, but if extraction gets easier then the value proposition leans towards the one with most comprehensive set of tools. The data extraction part would cease to add value.

At the moment the XBRL adoption process is hung up in committees trying to settle the standard. Extensive negotiations between competing software vendors, financial experts, and company CFOs has not produced a coherent standard. It may be up to the SEC, through the Financial Accounting Standards Board (FASB), to come in and adjudicate the various disputes.

Even so, progress has been made. In the past few months major decisions have been reached on the major “taxonomies” (essentially, the standard tagging structure for various types of industry) under discussion.

Now 90% of companies are covered, while extensions of XBRL for specific industries, like oil or banking, are still being developed.

On February 3rd of this year, the SEC adopted a rule establishing a voluntary program for publishing XBRL data on Edgar:

The primary purpose of the voluntary program is to assess XBRL technology, including both the ability of registrants to tag their financial information using XBRL and the benefits of using tagged data for analysis.

Many voluntary programs with the SEC become mandatory if successful. Like the recent roll-out of Sarbanes-Oxley, XBRL could be the next financial reporting resource crisis.

Josh Poulson

Posted in category “Business” Tuesday, Feb 8 2005 02:12 PM | Permalink | No comments | No trackbacks

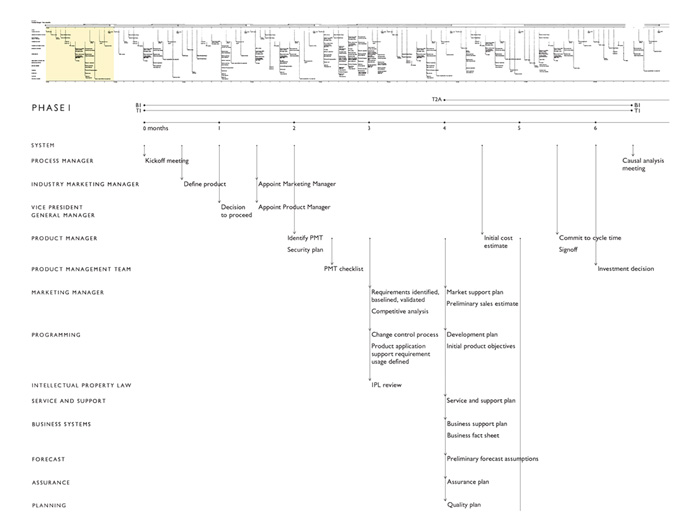

I'm hacking together a roadmap discussion for my boss tomorrow and spent much of the week getting things together from my group. When it comes to making a presentation of that material, however, I have a lot of flexibility. However, I also have limitations. Only one of the people involved in the presentation will be local to me. All of us will be on a conference call. I'll be sending any information out in advance and then talking to slides as everyone will sit there and page through the material at their own pace. It's extremely non-linear and unfocused.

I think a lot of remote presentations suffer from this problem.

This weekend my copy of The Cognitive Style of Powerpoint arrived, and I have to agree with much of what Tufte wrote. It's hard to drive a discussion with Powerpoint. He indicated that when it came to getting a lot of data across to an audience it was better to write a technical paper and distribute printed copies of it. In my experience this often leads to people paging through the material instead of paying attention to the speaker. However, my primary experience with this is teaching basic firearms skills to a diverse group of people.

I did a little more poking around and found that Tufte's web site has a discussion on how to present and handle project management information. The usual problems with Microsoft Project crop up first. Also many of the same problems I mention are covered.

Even in my normal 1600x1200 mode, Microsoft Project's Gantt charts are not an easy way to get a handle on the big picture. It does, however, allow one to roll up details if needed and expand them when it's relevant.

I did like Tufte's project plan displays (shown above), though. Less grids, more meat, obvious visual flow of work. Especially nice was the bigger picture view at the top so you could see the plan in context. Why on earth can't project management programs do this? I have hopes for Open Workbench but since IBM bought one of their competitors I don't think I will have all that much influence on an open source project management program.

Tufte made the above chart with Adobe Illustrator by hand. He didn't programmatically generate it. Obviously doing this sort of thing back hand is time-consuming. Time is something few of us have in surplus, but we would all like to transmit information better.

I suspect I'll end up splitting things up, which Tufte warns against. Pretty much each of my teams will have their own slides, with features at the top, quarter-by-quarter, major releases highlighted, and supporting processes at the bottom. This is a cliché, but it's comfortable to everyone involved, including myself.

Amazon.com links:

Josh Poulson

Posted in category “Business” Sunday, Jan 30 2005 02:09 PM | Permalink | No comments | No trackbacks

There's an old Dilbert comic, which I'll avoid posting here due to copyright problems, that featured a presentation where an audience member collapses due to “PowerPoint poisoning.” Another strip has Dilbert critiquing a presenter, accusing him of having a “PowerPoint disability.”

In the course of my work I encounter a heck of a lot of presentations, many made with OpenOffice but more often than not it's PowerPoint. It's a tool where a little knowledge and default templates are an agonizing thing.

Recently, because I read Tufte's blog, “Ask E.T.”, I read a review of The Cognitive Style of Powerpoint in the Marine Corps Gazette column “Survival for Briefers.” It reminded me that I have not yet ordered this book and consumed it. (Many who know me might scoff at the idea of an interesting book that I do not own.)

A search for the Dilbert cartoon, I found this article on scoring PowerPoints. More good reading beyond the well-recommended $7 book from Tufte.

With the sheer number of presentations that go through our office, I plan on working on presentation skills with my group. With any luck, we can have a viral effect on the rest of the organization.

Amazon.com links:

Josh Poulson

Posted in category “Business” Wednesday, Jan 26 2005 04:23 PM | Permalink | No comments | 1 trackback

Last night Brent from Ironwood came over, ostensibly to get TiVo working on my DirecTV connection, but really we need to get my dish working for both DirecTV and DirecWay. After five hours of replacing almost everything except the reflector on my dish we got things working better than they've ever been before.

Almost all of my connections were corroded, including the new stuff we got a year ago when we got my Internet connection working. Ground blocks and splitters were clearly shorted and ruined. The sidecar on my dish had corroded out. A wasp's nest was living under my weather cover. At least one of my satellite receivers was cooked (which was okay, we were replacing it).

The main take-away from the whole deal is that the installed from DBS (local installers, not the Direct Broadcast Satellite company) that came out to do my job last year did a crappy job. I'm not afraid to say it. I looked at the connections. There was water and brown corrosion inside the connectors when we pulled them off. The new stuff has dielectric compound and rubber grommets. At least we didn't have to replace any cabling.

On the other side of it, the pipe that my fifty-pound dish hangs on was also pretty darn bad. I could make the whole thing shake with my finger. Not a big deal for DirecTV reception, but my Internet transmission side is quite sensitive to being aimed correctly. I suspect my overall Internet experience will greatly improve.

So, thanks Brent from Ironwood. Jeers to DBS.

Josh Poulson

Posted in category “Business” Saturday, Jan 8 2005 10:07 AM | Permalink | 2 comments | 1 trackback

Via Brainstorms and Raves we find that IE's market share keeps dropping after the large marketing push for Firefox.

While my wife likes the integrated Mozilla package better, we have been using Firefox (and Thunderbird) for some time now. I test my web site with IE, Mozilla, and Opera regularly and with my involvement with Linux, Mozilla/Firefox is definitely my browser of choice. Why? Mainly because I support open standards, especially when it comes to the web.

Even so, IE is used by just under 80% of visitors to my site.

With Microsoft's efforts today concerning viruses, spyware, and pop-up ads, maybe they can fight against this loss of market share. To me it seems like a half effort, too late, except Microsoft has a history of making baby steps before it dominates and destroys a market that interferes with its ownership of mass market computing platforms. At the moment their anti-spyware software is going into beta. We'll see how it does against Spybot Search & Destroy and Lavasoft AdAware, both of which I recommend.

Update: Well, I ran Microsoft's tool and it did find something, although I haven't run any anti-spyware stuff in a little over a week. It has an always active piece that I'll watch to see if it interferes with anything. Since I also have Norton Antivirus and Zone Labs Integrity Client running constantly, we'll see if this newcomer picks a fight with them.

Amazon.com links:

Josh Poulson

Posted in category “Business” Thursday, Jan 6 2005 09:19 AM | Permalink | No comments | 1 trackback

Via Slashdot we find this EE Times article telling us that HP and Intel have ceased their Itanium codevelopment alliance.

The move follows disappointing sales for servers based on the processor, according to the report. Intel and HP developed the processor about 10 years, but the chip has been a flop due to delays, cost overruns and lackluster demand.

Some will herald this as the success of AMD64, others might think it has more to do with PowerPC.

Josh Poulson

Posted in category “Business” Saturday, Dec 18 2004 09:11 AM | Permalink | No comments | 1 trackback

The Volokh Conspiracy's Todd Zywicki examines Cracks in the Lawyer Cartel. I have always been amused by the ways that the legal profession attempts to regulate and control who may assume what role in a variety of situations. I have seen it in other professions as well, for example the recent (failed) attempt to create a tier of “Certified MBAs.” How long before project management is tied to those who maintain a PMP certification? (I've considered acquiring this certification, but I'm busy with my schoolwork.)

Since my father is a few days away from 2.5L, I've been looking more into the legal profession and its workings. It's been pretty enlightening. My previous exposure to this has been from the side of a particular “deep” area, namely Use of Force. My time in Lethal Force Institute courses and instructor training have taught me more than I really wanted to know about police and legal work.

I've encounted patents and employment law in the software business and I did take a Business Law course when I made my first run at an MBA a few years ago. (Someday I should tell my story about why I think University of Phoenix is a waste of money.)

All it all, it's been enough for my wife to think I might be interested in being a lawyer. It all sounds so limiting to me.

Josh Poulson

Posted in category “Business” Friday, Dec 17 2004 10:28 PM | Permalink | No comments | No trackbacks

So, I'm reading the latest edition of The Intelligent Investor by Benjamin Graham. In it he describes the difference between investing and speculation. According to Graham, investing requires these three elements:

Any activity that does not include all three elements is speculation, not investing, and oneshould expect money used for such purposes to be essentially lost if not for luck.

Some folks may be taken aback by such a strict definition. In the book Graham berates Wall Street for softening the definitions. Day traders are hardly investors. They are speculators.

Pretty interesting insight, and I'm only a few chapters into the book.

Amazon.com links:

Josh Poulson

Posted in category “Business” Thursday, Dec 16 2004 09:13 PM | Permalink | No comments | No trackbacks

Seems to be a good time for mergers. IBM's deal with Lenovo to sell it's PC Division is only the tip of the restructuring iceberg in the past few weeks.